Investing in the Green Transition and Competition from Laggards

Published in Mimeo, 2024

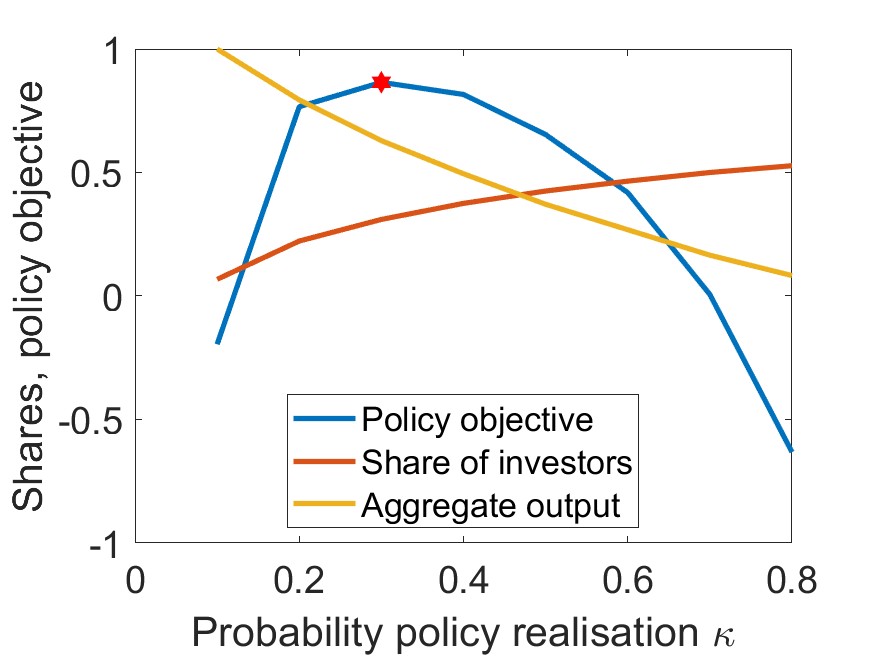

We study heterogeneous firms’ decision-making for investment into greening their production process. Empirically, we find that firms primarily use their own funds for greening investment, more productive firms have a higher propensity to invest more into greening their production process, and firms that face more competition invest less. We incorporate these stylized facts into a heterogeneous firm model where a firm’s decision to engage in greening investment depends positively on idiosyncratic firm productivity and firm profitability. We show that hence greening is negatively affected by the firm’s current and future expected competition and profitability. Lower profitability reduces the ability of firms to raise funds for greening, and lower future expected profits reduce the incentive to do so. We discuss in this context the effect of a policymaker outlining an uncertain path for a future greening of the production process forcing brown firms out. Comparing stationary equilibria in the full model under perfect competition, we verify that a higher probability of a green policy mandate increases the share of firms engaging in greening investment and that competition from non-investors decreases the share of firms engaging in greening investment. The optimal path outlined by the policymaker depends on the willingness to trade off temporary output losses and a higher share of green production. However, a low probability of transition will endogenously reduce the current greening share by reducing the current ability of potentially greening firms to invest through the current competition from brown firms.

Recommended citation: Saecker, Johanna and Philip Schnattinger. (2024). Investing in the Green Transition and Competition from Laggards, Mimeo.